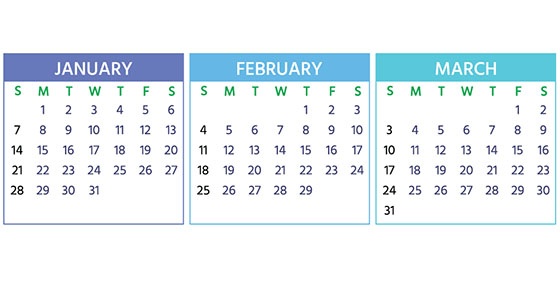

Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. If you have questions about filing requirements, contact us. We can ensure you’re meeting all applicable deadlines.

January 16 (The usual deadline of January 15 is a federal holiday)

- Pay the final installment of 2023 estimated tax.

- Farmers and fishermen: Pay estimated tax for 2023. If you don’t pay your estimated tax by January 16, you must file your 2023 return and pay all tax due by March 1, 2024, to avoid an estimated tax penalty.

January 31

- File 2023 Forms W-2, “Wage and Tax Statement,” with the Social Security Administration and provide copies to your employees.

- Provide copies of 2023 Forms 1099-NEC, “Nonemployee Compensation,” to recipients of income from your business, where required, and file them with the IRS.

- Provide copies of 2023 Forms 1099-MISC, “Miscellaneous Information,” reporting certain types of payments to recipients.

- File Form 940, “Employer’s Annual Federal Unemployment (FUTA) Tax Return,” for 2023. If your undeposited tax is $500 or less, you can either pay it with your return or deposit it. If it’s more than $500, you must deposit it. However, if you deposited the tax for the year in full and on time, you have until February 12 to file the return.

- File Form 941, “Employer’s Quarterly Federal Tax Return,” to report Medicare, Social Security and income taxes withheld in the fourth quarter of 2023. If your tax liability is less than $2,500, you can pay it in full with a timely filed return. If you deposited the tax for the quarter in full and on time, you have until February 12 to file the return. (Employers that have an estimated annual employment tax liability of $1,000 or less may be eligible to file Form 944, “Employer’s Annual Federal Tax Return.”)

- File Form 945, “Annual Return of Withheld Federal Income Tax,” for 2023 to report income tax withheld on all nonpayroll items, including backup withholding and withholding on accounts such as pensions, annuities and IRAs. If your tax liability is less than $2,500, you can pay it in full with a timely filed return. If you deposited the tax for the year in full and on time, you have until February 12 to file the return.

February 15

- Give annual information statements to recipients of certain payments you made during 2023. You can use the appropriate version of Form 1099 or other information return. Form 1099 can be issued electronically with the consent of the recipient. This due date applies only to the following types of payments:

- All payments reported on Form 1099-B.

- All payments reported on Form 1099-S.

- Substitute payments reported in box 8 or gross proceeds paid to an attorney reported in box 10 of Form 1099-MISC.

February 28

- File 2023 Forms 1099-MISC with the IRS if you’re filing paper copies. (Otherwise, the filing deadline is April 1.)

March 15

- If a calendar-year partnership or S corporation, file or extend your 2023 tax return and pay any tax due. If the return isn’t extended, this is also the last day to make 2023 contributions to pension and profit-sharing plans.

© 2023

TopLine Content Marketing Team